Hilton Tops Extended-Stay Field

Hilton's Home2 Suites and Homewood Suites brands led the company to victory in several criteria, and they'll soon be joined by a third brand: LivSmart Studios.

By Chris Davis

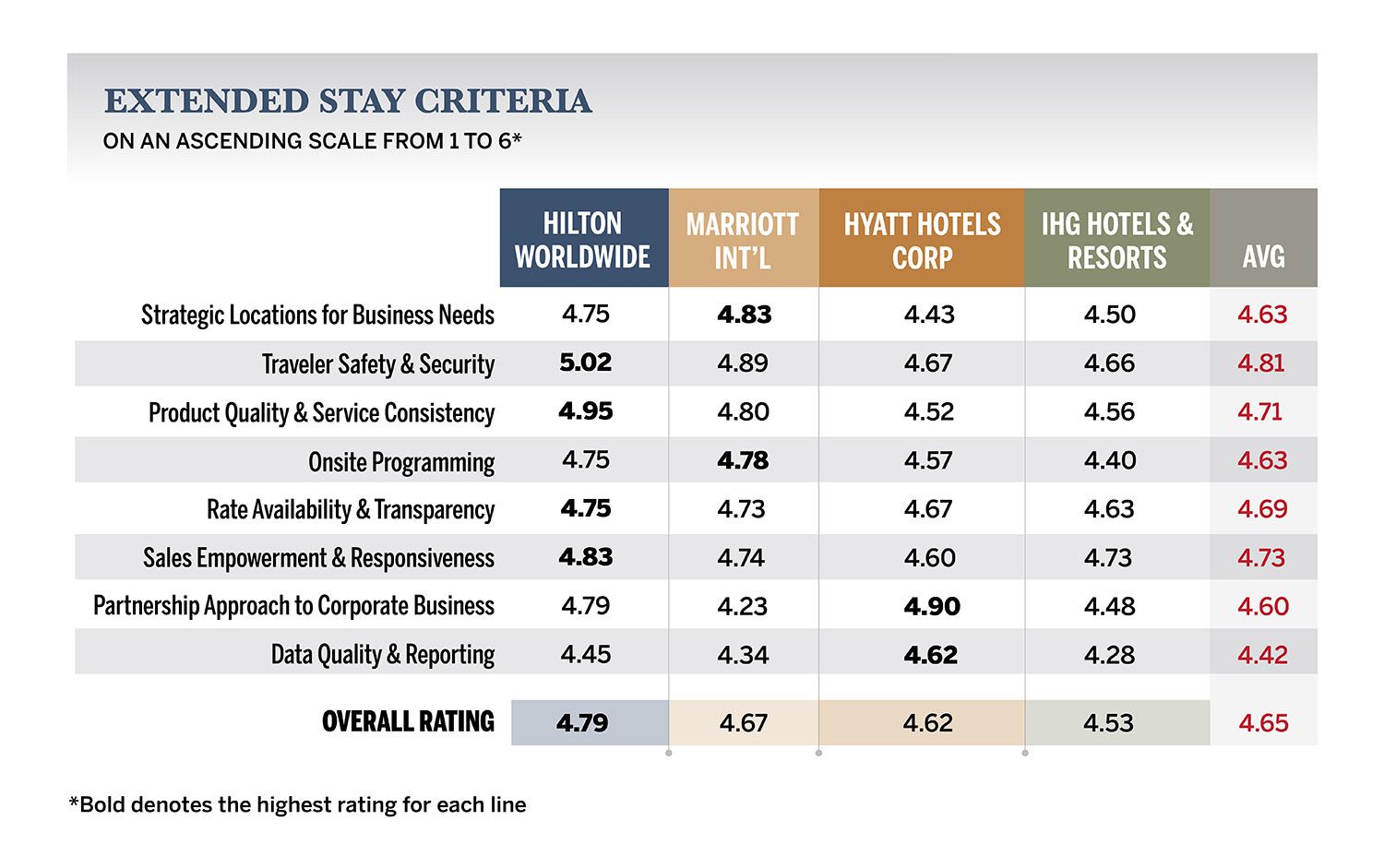

In a U.S. market where supply continues to increase only gradually, Hilton Worldwide's brands solidly topped the extended-stay portion of BTN's annual Hotel Survey, besting its nearest competitor by more than a tenth of a point on an ascending one-to-six scale.

U.S. extended-stay demand thus far in 2024 has been something less consistent, not unlike standard hotels, with a softer first quarter leading to a sturdier second quarter. Supply growth, however, has been slow. Extended-stay analysts The Highland Group earlier this year noted the supply growth rate was at its slowest in a decade, and even as that pace increased throughout the year, principal Mark Skinner noted the "annualized increase in room nights available over the next year should be well below the long-term average."

Overall extended-stay scores in BTN's survey generally slipped from last year's edition, down to an average of 4.66 from 4.80.

Unlike the main hotel survey, in which it only finished first in one criteria even as it posted the overall highest score, Hilton in the extended-stay survey won four criteria: traveler safety and security, product quality and service consistency, rate availability and transparency, and sales empowerment and responsiveness.

Hilton VP of global business travel sales Christiane Cabot Bini pointed to the extended-stay sector as one in which corporate partnerships have been key.

"Many of our customers in the extended-stay and project space became folks that we could lean on during the pandemic. During very difficult times, they really helped us," she said. “We try to empower our sales teams to be thoughtful or to answer the needs of our customers in this space. We have stood up specialty servicing just for [this segment]."

Hilton's extended-stay portfolio currently includes the Home2 Suites and Homewood Suites brands, and soon will be joined by a third: LivSmart Studios, a lower-midscale extended-stay brand slated to open its first property in Kokomo, Ind., by year-end.

"That brand was designed entirely from the feedback from our customers in the extended-stay category. It includes thoughtful design that is based on walking our customers through demo rooms and asking them, 'What do you think about this?' " Bini said. "Storage in places that you wouldn't even think about, having drop zones for meal delivery services … thoughtful design that is based on our users in the space and really making sure that we are creating something purpose-built for their needs."

Marriott Tops Location, Programming

As it did in the main survey, Marriott International finished second, leading in two criteria: strategic locations for business needs and onsite programming. The latter concerns onsite community, fitness and social opportunities and other consistent programming, and SVP of global sales Tammy Routh said Marriott's wealth of experience in extended stay has helped guide its onsite offerings.

"We have a lot of expertise, and our extended-stay brand leaders and our operators are really focused on onsite programming for the guest. It's a specialty," she said. "Whether it is barbecues or receptions with the general manager or all kinds of things, each brand has kind of their own niche and general managers really work hard."

Marriott in 2023 announced a new extended-stay brand, StudioRes, joining its existing extended-stay options including Element by Westin, Residence Inn and TownePlace Suites. StudioRes will be a new-build midscale extended-stay brand; the first such property broke ground this year in Ft. Myers, Fla., and is slated to open in 2025.

"There's some niches in that segment where we were not playing," Routh said, citing StudioRes and Marriott's recent deal to add Sonder Holdings' apartment-style offerings to its inventory as indicative of the company's intent to provide expanded extended-stay options in more locations.

Routh said corporate extended-stay demand was roughly tracking with other aspects of business travel demand, and noted some corporate clients' focus on limiting flights to help achieve sustainability goals was helping to bolster the segment.

Hyatt Preps New Brand

Hyatt Hotels Corp. finished third in the extended-stay survey based largely on the performance of Hyatt House, its extended-stay brand. Soon, though, Hyatt will add a second extended-stay brand: Hyatt Studios, announced last year and slated to open its first property in Mobile, Ala., by year-end.

"With extended stay, I think we have built a very good following with our Hyatt Place and Hyatt House brands," Hyatt VP of global sales Christina Gambini said. "Where we realized we had an opportunity was in some of the secondary and tertiary markets where we didn't have a Hyatt brand at all. Hyatt Studios is our answer to that. We're looking at additional markets where we know our customers are asking for a Hyatt hotel and we're lacking."

Hyatt won two categories in the extended-stay survey: data quality and reporting and, as it did in the main survey, its partnership approach to corporate business.

"Where we realized we had an opportunity was in some of the secondary and tertiary markets where we didn't have a Hyatt brand at all. Hyatt Studios is our answer to that.”

IHG Readies Expansion

IHG Hotels & Resorts' longtime extended-stay brands Candlewood Suites and Staybridge Suites topped the extended-stay chart in last year's survey but this year tumbled. Still, the company this year has noted expansion plans for both extended-stay brands, along with Atwell Suites, the upper-midscale extended-stay brand it launched in 2022 and for which it has opened a handful of properties.

IHG this year for each of the three extended-stay brands unveiled new U.S. prototypes, available in 2025 and designed to supplement, not replace, existing options. The prototypes "emphasize space optimization and the potential for new efficiencies while retaining key features from current designs," according to IHG.

Upscale Staybridge Suites has about 325 existing properties with more than 160 in the development pipeline, while there are about 376 midscale Candlewood properties currently open and another 150 in the pipeline. Three Atwell properties are open with 41 in the pipeline, according to IHG.