Hilton Triumphs in Traditional-Hotel Rankings

The hotel company earns a close victory over a crowded field in BTN's annual survey of corporate travel buyers, riding high marks across the board to the top.

By Chris Davis

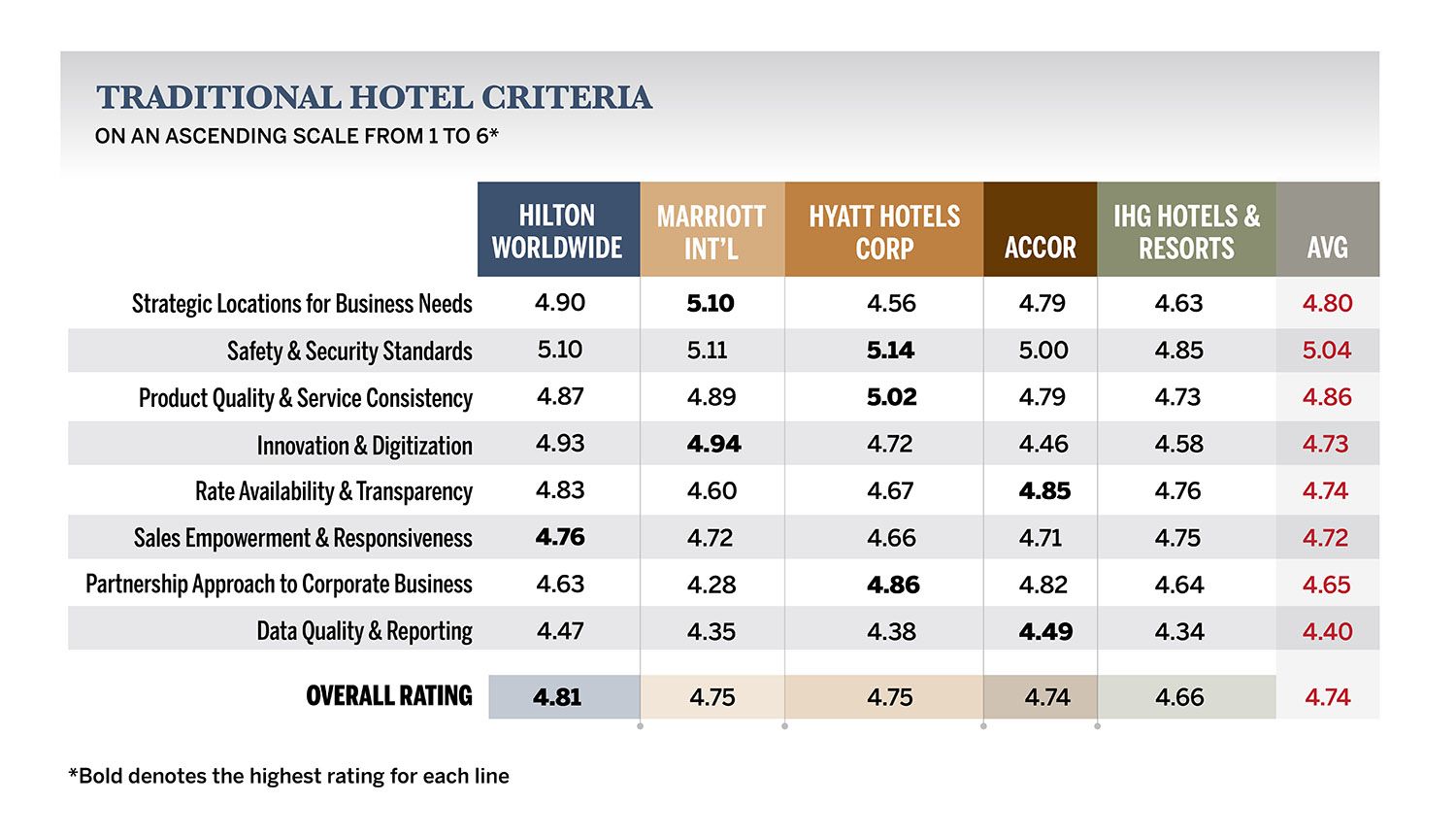

Hilton Worldwide has topped BTN's annual survey of corporate travel buyers' opinions of the hotel chains with which they do business, although the field was tightly packed and four hotel companies could say they won at least one category.

BTN asked survey respondents to rate major hotel chains across eight criteria: strategic locations and brand portfolio for business needs; safety and security standards; product quality and service consistency for each brand; innovation and digitization; rate availability and transparency; sales empowerment and responsiveness; a partnership approach to corporate business including rate flexibility; and data quality and reporting.

Hilton Worldwide secured the first-place ranking, although it was a close race, with Hilton only six-hundredths of a point ahead of Marriott International and Hyatt Hotels Corp. Interestingly, Hilton finished first in only one individual category—sales empowerment and responsiveness—fewer than Marriott, Hyatt and Accor. But Hilton managed to secure the overall first-place ranking with consistently high scored across all categories, including four categories in which it placed within five-hundredths of a point behind the leader.

Hilton has had an active year, acquiring the upper-upscale Graduate Hotels brand, taking a majority stake in the parent company of the luxury NoMad Hotel with plans to expand the brand, and, notably for the corporate market, launching Hilton for Business, a rewards program designed for small and midsized enterprises.

The moves will help Hilton in a business travel market in which demand has "pretty much stabilized at this point," with post-pandemic workplace trends settling, said Hilton VP of global business travel sales Christiane Cabot Bini.

The BTN survey's sales empowerment and responsiveness category, in which Hilton scored highest, is a measure of the ability of sales teams and account managers to communicate, resolve problems and be empowered to create value. Bini said that reflects the ways in which Hilton salespeople are trained to work with corporate clients.

"How do we partner to create a balanced relationship where both sides are seeing benefit out of the relationship? One dimension of that can be rate, but it can be share, it can be loyalty."

"I'm glad to hear that it is being felt because certainly the way that we talk to our team members across the board is that they are empowered to listen to the customer's needs and to come up with ideas and solutions and constructs that work for everyone," Bini said.

In a corporate sales environment, she said, finding such a solution can require salespeople to look for value opportunities beyond a negotiated rate.

"When I think about our customer relationships and customer needs, a lot of times it can mean how we negotiate with them around rate," Bini said. "But I think of it in broader terms: How do we partner to create a balanced relationship where both sides are seeing benefit out of the relationship? One dimension of that can be rate, but it can be share, it can be loyalty. And the way in which we bring programs forward that their corporate travelers see as really beneficial."

Bini noted that salespeople often are empowered to include non-rate elements like fast-track Honors loyalty status with corporate accounts.

Hilton for Business, which also includes self-service volume dashboards, has been going "gangbusters" since its January debut, Bini said. "We built Hilton for Business by talking to small business owners and asking them, what are their pain points? What are their challenges? How can we design something that specifically meets their needs? And a great program was built, and we are adding features and functionality every day to the program."

On the other hand, for large global corporate customers, "you're going to see multiple team members from around the world across all of our various regions and also the segments of business that they have, whether that is business travel or meetings and events needs," she said.

Marriott Leads Innovation, Location

Marriott International, which tied with Hyatt for second and topped two categories, including offering strategic locations for business needs, a category that measures a chain's ability to provide sufficient options at appropriate service tiers and geographic locations. It's a category that lends itself to the survey's largest chain by global properties and rooms, and Marriott SVP of global sales Tammy Routh said the company continues to take deliberate steps to broaden its coverage of service tiers and locations.

"Our strategy as a company is to be anywhere our customers need us to be with the right product," Routh said. Marriott in recent years has broadened into the midscale tier with its acquisition of City Express and launch of Four Points Express by Sheraton, and in August agreed to include apartment-style accommodation provider Sonder's offerings in its portfolio.

"In an ideal world, we have something for you no matter where you're going, at whatever price point or trip purpose," Routh said. "We're very dependent on the corporate market, whether that be business travel [or] meetings and events. So our development team is looking for places we are not [in], where we could better serve our customers."

Marriott also led—by a hundredth of a point—in the survey's innovation and digitization category, which highlights chains' ability to offer onsite experiential elements but also innovation within its loyalty program and mobile app. Routh suggested Marriott's victory in the category was a function of the chain's work to elevate and broaden the functionality of its Bonvoy loyalty program and its effort to raise its salience within corporate programs.

"We've worked really hard on taking what is traditionally a B-to-C program and making sure the B-to-B customers understand the value of it, and we're going to continue to work on more B-to-B offerings in the future," Routh said, pointing out Bonvoy functionality, including mobile check-in and room key technology, among others. "It's more about the language that Marriott speaks in all 9,000 hotels is a Bonvoy language. … If you want to operationalize something, it's through that loyalty program."

Among Marriott's Bonvoy initiatives for the corporate market is Business Access by Marriott Bonvoy, a program launched in July and designed for small and midsized enterprises that offers not only loyalty points and discounts but also a suite of travel and expense management tools underpinned by a Spotnana tech stack and available only to Bonvoy members. Demand so far has been good, Routh said.

"We're really pleased at the uptake of that, and it's something that launched from the ground up," she said, adding that the genesis for the program was customer feedback. "This is not competing with travel agencies. This is something that gives the executive assistant or … travel manager [the ability] to do self-service. 'I can go into a portal. I can look at my data and reporting I can put in the travel policy and drive compliance through that.' "

"We've worked really hard on taking what is traditionally a B-to-C program and making sure the B-to-B customers understand the value of it, and we're going to continue to work on more B-to-B offerings in the future."

Still, Marriott's worst category in the survey was its partnership approach for corporate business, in which it finished solidly behind the other four companies in the survey. Routh said she thought the score was a result of Marriott's stance during corporate negotiations.

"Obviously it's disappointing to see that. I know exactly what it is," Routh said. "We have taken a stance for 2025 pricing that is hard. It's hard to do change in this space. It's hard for our hotels. It's hard for our customers, when we've all been doing it the same way for a very long time.

"We know exactly how to run these [requests for proposals] on both sides. We know how to measure it. It's easier to do the status quo. We have been asked to change that for 2025 with just some different kinds of things that are going to make this process better, hopefully for all. So that's a little bit more about the dynamic pricing. It's looking for things that maybe are not necessarily last-room availability in all cases."

Routh stressed that Marriott's sales reps have been instructed to work with clients, and that the chain values long-term relationships with its corporate accounts. "We need this business," she said. "Our hotels need it and so we will find a way to create a solution that works for all."

Photo caption: Marriott was tops for hotel options in key business markets; here, the Marriott Champs Elysees in Paris.

Hyatt's Partnership Approach Lauded

Hyatt Hotels Corp. finished in a second-place tie with Marriott International, six-hundredths of a point behind Hilton. Hyatt finished first in three categories: safety and security standards, product quality and service consistency, and partnership approach to corporate business.

That last segment is critical for Hyatt, said Christina Gambini, who in April was promoted to Hyatt's VP of global sales, because of the segment's prominence: Corporate in the second quarter was Hyatt's top customer segment, she said. "For us, corporate is the segment that is leading our space right now," she said.

Gambini suggested Hyatt's victory in the partnership approach category is a function of the chain's communication strategy with its corporate clientele, and also noted that, given its smaller size than some of its competitors, it relies on a personal approach.

"Because we are one of these smaller ones, we focus on that personalization, that relationship with all of our customers ensuring that one-to-one support wherever possible," Gambini said. "We engage with them consistently throughout the year to ensure, are we on the right path? How are things going? Do we need to pivot and adapt based on what might be happening in their organization or ours? That's been really important to us and something that we've heard from our customers sets us apart from the others."

Hyatt Hotels introduced two boutique hotels in New Orleans this summer, the Maison Metier and The Barnett

Hyatt Hotels introduced two boutique hotels in New Orleans this summer, the Maison Metier and The Barnett

Gambini also highlighted Hyatt Leverage, the discount program for small and midsized enterprises launched in 2018, which she noted offers traveler-tracking and volume dashboards for companies who may not have a formal travel management company relationship, and the company's annual Corporate Travel Exchange meeting for corporate clients.

This year, Hyatt's request-for-proposal is unfolding similar to those in prior years, she said, without much push among clients to rethink typical hotel contracts. "There are new tools being discussed and considered … but we haven't seen a drastic shift yet. It's an account here and there that's maybe looking at a different technology offering."

Hyatt also topped the field in product quality and service consistency, a measure of properties' cleanliness, maintenance, amenities and service. "We do have a distinct portfolio of brands and properties across the globe that offer a unique set of guest offerings and signature experiences," Gambini said. "But providing clean and comfortable environments for our guests is always the top priority, regardless of the brand or property. Each of our hotels has goals in that area as well that they have to adhere to."

Hyatt's victory in the safety and security measures category was close—both Marriott and Hilton were a trace behind with high scores of their own. Gambini said on-property security teams in many cases are staffed with ex-military or former law enforcement officers, and the company employs both integrated onsite surveillance systems and block and access control systems.

Additionally, "we have a security director for each region that is responsible for ensuring that all the properties are adhering to all of our safety guidelines, and that's something that happens regularly," she said.

"There are new [travel management] tools being discussed and considered … but we haven't seen a drastic shift yet. It's an account here and there that's maybe looking at a different technology offering."

Accor Tops in Data, Transparency

French hotel giant Accor may have finished fourth in the survey, but it was only one-hundredth of a point behind second-place twosome Marriott and Hyatt and just seven-hundredths of a point behind leader Hilton.

Accor also finished first in two categories: rate availability and transparency and data quality and reporting.

Accor this year created an advisory board of corporate travel managers and buyers, designed to help the hotel company identify and react to industry trends.

The hotel company identified neither the advisory board members nor their companies but did say in a statement that they represented 17 firms from around the world "from sectors such as financial services, engineering, manufacturing, transportation, energy, professional services and technology," and in aggregate represented firms with 2.7 million business travelers.

The group first met this summer in Paris, according to Accor, and was led by chief sales officer Sophie Hulgard. The members "unanimously" agreed that the three top priorities for business travel are traveler experience and well-being, cost management and optimization, and sustainability, in that order.