For the 10th year in a row, travel buyers rated Delta Air

Lines as the top carrier in BTN’s Airline Survey, atop a tide of improved buyer

satisfaction with airlines even as they faced a near total evaporation of

corporate travel demand amid the Covid-19 pandemic.

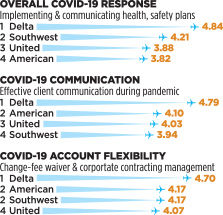

Delta earned a total score of 4.59 on a five-point scale and

once again earned the highest score among its competitors in all criteria

measured in the survey. BTN this year added three criteria specific to

airlines’ Covid-19 response, but the rest of the categories were consistent

with last year’s survey. Delta also improved its score year over year in all

survey criteria.

Delta was not alone in its improvement, however. More than

60 percent of buyers in the survey indicated that their customer service had

improved since last year. A third said customer service had stayed the same,

leaving only a small percentage indicating it had gotten worse.

American Airlines and Southwest Airlines each improved

across all comparable categories year over year, while United Airlines, which

ranked second last year, fell a bit year over year. For American, that was

enough to surpass United to rank second this year, and Southwest remained in

fourth, though the spread between all three airlines was just 0.06 points.

As corporate air travel has recovered as yet only to a small

fraction of where it was prior to the pandemic, much of the commentary in

open-ended questions in the survey centered around two key areas: communication

and flexibility.

Communication Removes Barriers

Hygiene and sanitization procedures have taken center stage

amid the pandemic, and they also are playing a critical role in airline communication

strategies they hope will lay the groundwork for a corporate travel rebound.

Both client communication and effective communication

related to Covid were among Delta’s highest-scoring areas. Several buyers in

open-ended questions praised the carrier’s response.

“Our Delta rep kept informing us about their plan and the

situation of Covid-19,” one buyer wrote. “As a frontline industry, we are still

heavily traveling, so it is a big help to have an account manager who cares

about our business and travelers.”

Another buyer noted that Delta’s “communication and sales

reps have been phenomenal during the pandemic,” with “everything from emails to

airport and plane inspections.”

Delta VP of sales operations and development Kristen Shovlin

said Delta has “hit every channel” in its communication strategy to provide a

“constant flow of communication.” That has included producing videos to show

the new traveler experience amid Covid-19 precautions, bringing in experts to

answer questions, hosting town halls and talking one-on-one with corporate

clients, she said.

Delta also has hosted more than 500 fam trips for more than

2,500 customers, so they can see firsthand the measures in place, SVP of global

sales Bob Somers said.

American also has been conducting airport tours with clients

and agencies, which helps “take the mystery out of the check-in experience,”

managing director of strategic account sales Hank Benedetti said. The tours let

buyers see such procedures as the cleaning of aircraft and application of the

SurfaceWise antiviral treatment, he said.

For Southwest Airlines, the pandemic was an impetus to

create “an industry-standard marketing automation tool,” which it previously

did not have, Southwest Business VP Dave Harvey said. The resulting tool allows

Southwest to message travel managers globally and equips account managers to

customize their own communication, he said.

“It’s allowed us to be more timely and more tailored with

our messaging,” Harvey said. “If we need to get something out about the Southwest

promise or schedule changes, we can go through a decision tree about the most

effective platform. Our communications muscle has been taken up a notch.”

In recent months, airlines have reported that all-out travel

freezes have ended for most of their corporate clients, with a majority of them

having at least some small level of travel. Having those communication

strategies in place in turn is meant to help buyers who now need to gauge how

to send their travelers back out on the road.

“Every day, all day, we’re on calls with customers,” Somers

said. “It started with corporate travel managers, and now it’s chief medical

officers and risk officers, and they’re sharing it with their traveling

employees. Science and government will drive when people come back to work, but

we’re making sure people have the confidence to travel.”

Airlines now are expanding that communication strategy to

include other parts of the travel ecosystem. American, for example, is

partnering with companies including Hyatt, Marriott and Avis to “showcase the

entire journey,” chief customer officer Alison Taylor said. United has put

together a “return-to-travel” toolkit for buyers with multiple resources from

them to pass on to travelers, VP of sales strategy and effectiveness Glenn Hollister

said.

“Air travel is not seen as the barrier to business travel at

this point,” Hollister said. “The barriers we’re hearing about now have more to

do with travel restrictions imposed by governments and the simple fact that, in

reaction to those, many offices are closed.”

Making Changes for Flexibility

Since business travel grinded to a quick halt in March,

flexibility has been the second crucial need for buyers from airlines, both in

travel booking and in the contractual relationship.

In the early days of the crisis, airlines responded with

change fee waivers, as they would have during a natural disaster. As it became

clearer that this would be a more prolonged and global issue, unlike anything

the industry has faced before, some of those changes have crystallized into

something more permanent for the industry.

One of the biggest changes came this fall when airlines

announced that the elimination of change fees would be permanent, at least for

domestic travel. Policy changes have varied a bit across each airline. United,

which was the first to announce the permanent elimination, also eliminated fees

for same-day standby, Hollister said. American, meanwhile, so far has been the

only carrier to enable refunds of price differentials when new tickets are booked

at a lower price.

Southwest, of course, previously always had stood alone

among the four largest U.S. carriers in not charging change fees—nor

checked-bag fees—and “overall price value” continued to be its strongest area

of performance this year.

The increased flexibility has presented an added challenge

for buyers in dealing with unused tickets. Delta alone, for example, has issued

about 4 million refunds, totaling about $2.8 billion in revenue, Somers said.

The carrier worked to make sure agencies were able to manage name changes in

global distribution systems without having to go through Delta and worked to

create Universal Air Travel Plan accounts for customers to manage unused ticket

funds as well, Shovlin said. Southwest also formed a partnership with UATP to

form a process for buyers and travel management companies to aggregate unused

funds, Harvey said.

American took an additional step to ensure travelers were

not able to rebook unused tickets for corporate travel for personal use, making

sure they had to go through authorized agencies so new tickets were used for

business, Benedetti said.

As with the elimination in change fees, some structural

changes will be permanent. For example, airlines worked with ATPCO to automate

ticket changes for rules to match current information rather than what was the

case at the time of booking. The change, which ATPCO head of global accounts

Chris Phillips called “one of the most successful implementations ATPCO has

done in quite a while,” will continue to benefit the industry beyond Covid for

changes related to hurricanes or other natural disasters.

“We don’t want to build a single-use solution that will help

us for a few months,” Phillips said. “The solutions we’re delivering are ones

intended to be long-standing solutions for the industry that can be built on.”

Airlines have been flexible in other areas as well, such as

extending loyalty program points beyond expiration dates and extending status

into next year. They also have been extending corporate contracts, waiving

requirements on current contracts and lowering thresholds for programs

targeting small and midsize companies, which generally have been quicker to

rebound to travel than larger companies.

While airlines report some recent increases in request-for-proposals

activity, that flexibility with contracts will extend into next year.

American, for example, is extending all contracts set to

expire before June 30, 2021, by an additional year, though corporate customers

are also welcome to return to the negotiating table in lieu of an extension,

Benedetti said. “What we did very early on was place the power of choice with

the customers,” he said.

Looking Forward

Industry analysts project true recovery in corporate air

travel is unlikely to happen until at least later next year, pending widespread

distribution of effective vaccines, and airlines are positioning themselves to

take advantage when that recovery happens.

Delta has seen about 90 percent of its corporate customers

return to travel, with such industries as entertainment and manufacturing

leading the way, Somers said. It also has been leaning on its partnership with

private aviation supplier Wheels Up to offer a charter option for companies

returning to travel.

In the meantime, it has continued with investments in place

prior to the pandemic, such as in its sustainability efforts and helping to

build a better retail shopping experiences for air travel, Shovlin said.

American has announced several new partnerships over the

past year, including working with both Alaska Airlines and JetBlue, which fills

“obvious gaps in our Northwest and Northeast network,” Taylor said. In terms of

global network, American also is working with Qatar Airways and is adding its

own new services to Shanghai and Bangalore next year, she said.

“What’s next is making sure we have the right network in

place,” Taylor said. “Demand for next year is really starting to improve, and

that reassures corporate accounts, to see some normalcy returning.”

United is watching where demand rebounds to determine where

to add routes, Hollister said. It recently extended its service to Africa, and

major business travel routes on tap for next year include flying between

Chicago and New Delhi and between San Francisco and Bangalore.

The carrier also has developed a new data reporting method

for monitoring contract performance, working with ARC and Grasp Technologies to

flow corporate travel program identification information from TMCs to ARC,

enabling ARC to match that data with direct booking data. United will be moving

all U.S. point-of-sale customers to the new system and plans to have its

reporting available through its Jetstream portal next year.

Southwest this year delivered on its announcement last year

to make its content available for corporate travel via global distribution

systems without workarounds and has gone live in both Travelport and Amadeus’

systems. The carrier also is planning entry into two major airports—Chicago

O’Hare and Houston Bush Intercontinental, complementing its service at Chicago

Midway and Houston Hobby—which will open the door for some new potential

corporate customers, Harvey said.

“We feel like a combination of pillars are going to make

Southwest more attractive as we go into next year,” Harvey said. “Coupled with

the flexibility of funds and duty of care, plus all of the GDS and channel

investments we made, it’s going to be a dogfight for every customer.”

In recent weeks, airlines have been adding Covid testing

programs to open up travel opportunities to Hawaii and some Caribbean

destinations. Work is happening for key business destinations as well—United

recently introduced a testing program for travelers from Newark to London, for

example—and those efforts will continue to help business travel’s rebound.

Some buyers will have new relationships to build into the

new year, however, as many airline employees, including on the sales side, will

have left amid workforce reductions made necessary by the pandemic. Several

buyers in the survey indicated they were worried about losing representatives

they had worked with for years, though carriers said they have plans in place

for continuity. For example, sales team members that were customer-facing

“really had priority to remain at American” as it restructured, Taylor said.

“[Covid] did drive much more disruption in relationships we

had with the customer than I’ve ever seen, which is not desirable from ours or

the customer’s point of view,” United’s Hollister said. “We made sure we let

customers going through the process … know ahead of time the outcome for them

personally, so the person giving up a relationship can talk to the person

picking up the relationship and do a warm handoff.”

METHODOLOGY

From Sept. 24 to Oct. 26, BTN collected 576 responses from travel manager and buyer members of the BTN Research Council and subscribers of BTN and Travel Procurement and 92 responses from travel agents. Nine percent of the travel buyers spent less than $500,000 on U.S.-booked air volume in 2019, 12 percent spent $500,000 to $1.9 million, 37 percent spent $2 million to $12 million, and 43 percent spent more. BTN developed the categories with travel buyers, corporate travel agency managers and airline sales executives. The categories were the same as the 2019 survey with three additional categories to specifically address airlines’ response to the Covid-19 pandemic. BTN averaged scores in each category to create an overall score for each carrier, weighing each category equally. Respondents graded only those airlines with which they negotiated a contract or booked a meaningful amount of business in the past year. Participants who offered no response for a particular category or airline were not included in that category or airline’s average rating. The survey listed the largest domestic airlines as identified by the U.S. Department of Transportation, excluding regional affiliates of major carriers. Alaska Airlines, Frontier Airlines and JetBlue elicited responses from less than 30 percent of the final survey sample and therefore were excluded from this report. Equation Research hosted the survey and tabulated the results.